Disaster can show up at your farm out of the blue, will your insurance package cover your losses if it does?

Agriculture, Farm Operation March 01, 2021

Are You Covered?

Don’t be caught on thin ice when disasters strike.

Fires, floods, tornados and derecho windstorms can occur out of the blue and leave nothing but devastation in their wake. A list of items a farm can face legal action over is as long as your arm. Still, most farmers sleep soundly in the knowledge they have farm insurance in place to protect them when these disasters occur. But what happens if it doesn’t? Farmers often aren’t familiar with the fine print in their insurance policies, so some find themselves on thin ice when disaster strikes.

“We’ve some pending legal matters, that I can’t go into detail on, at our grain farm Northeast of Edmonton, Alberta” says Chris Allam. “They made us realize there are pitfalls to not dotting your Is and crossing your Ts. For example, whoever is taking action against you might be advised to use the shotgun approach and will serve anybody who owns any part of the operation. So, if grandma still has her name on some of the land, or if you have a land company as well as an operating company, you better have them included on your insurance policy. Otherwise, they might need to have a separate defense. It doesn’t cost much to include the extra names on your policy, but it will cause headaches if you’re sued and they aren’t.”

“Legal settlements are increasing in Canada and around the world,” says Blair McClinton, Farm Segment Director with SGI Canada in Regina, Saskatchewan. At one time it would be quite rare to see a farm that was carrying $10-million liability coverage but today it’s not unusual for larger farms to carry very high liability amounts. There are lots of things that can cause very significant losses.”

“Insurance companies are now looking for potential liability in your land rental agreements too,” Allam says. “If you have a crop share arrangement, you better have a clause in your contract that states you aren’t liable if there’s a crop shortfall. You don’t want them to come back at you if they were expecting to get a share of a 50-bushel canola crop, but you only harvested a 30-bushel one.”

Step by step. The first step is to sit down and take a close look at your insurance policies at least once a year,” McClinton says. “Look over the list of machinery and buildings you have on it. Has anything changed since the last time you talked with your broker? We often find people have been adding new buildings, grain storage or trading farm machinery regularly but haven’t added the new items and taken old items off their policies.”

Make sure your buildings and machinery are insured at the right value. Under insuring is the biggest problem; but you don’t want to be over insured either. Carrying replacement cost insurance on an obsolete building is a waste of money, because if you don’t replace it, you’ll only be paid for the old building’s actual cash value.

Most farmers have coverage for their machinery and buildings but fewer think about insuring their inventory. If 50 cattle fall through the ice on a slough, or if a 10,000 bushel bin of canola catches fire, it’s a big loss. It also mitigates your losses if a thief raids your fertilizer bins or chemical storage shed while you are on holidays.

“Farm insurance needs are changing too,” McClinton says. “A farmer might need drone coverage or cyber insurance to protect their data from hackers.”

Once you’ve reviewed your policy and know if you need to make adjustments, it’s time to sit down and have a frank conversation with your insurance broker, McClinton says. Perhaps they’re aware of options that are better for you. Make sure you inform them if you plan to make major changes, like doing custom farming work or selling directly to consumers, that can impact your coverage.

“Insurance isn’t an investment, it’s a risk management tool,” McClinton says. “If you’re not insuring something, you’re self-insuring it and you’re the one that carries all the risk.”

Blair McClinton with SGI Canada urges farmers to take a close look at your insurance policies at least once a year to make sure they are current.

Read More

Agriculture, Ag Tech

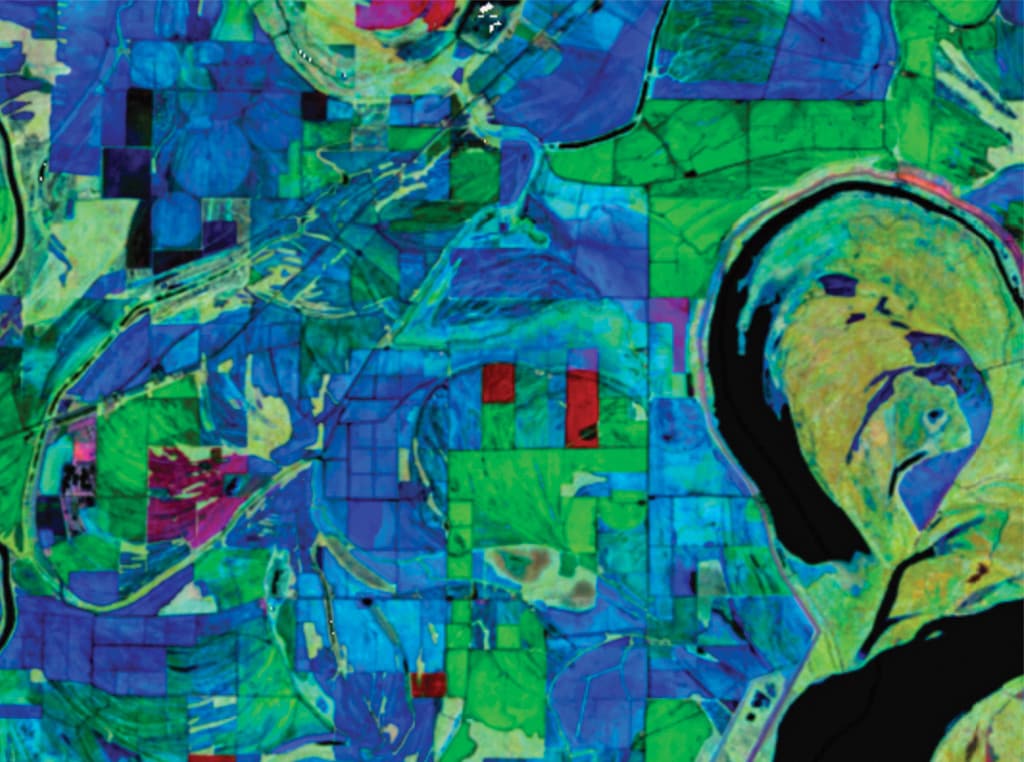

Ag Data Is Beautiful

Digital sattellite data paints farm masterpieces.

Agriculture, Specialty/Niche

Year-round Tourism

Muskoka farm develops innovative ways to incorporate four-season tourism attractions.