A Big Commitment to Compact Construction Equipment Financing

Your business’s success is our sole focus at John Deere Financial. That’s why we top off our low financing rates for compact construction equipment with expert knowledge of your industry, flexible payments, cost-effective maintenance packages, and the other financial tools to support your unique needs - at the jobsite or on the farm.

Compact Construction Equipment: Loan vs. Lease

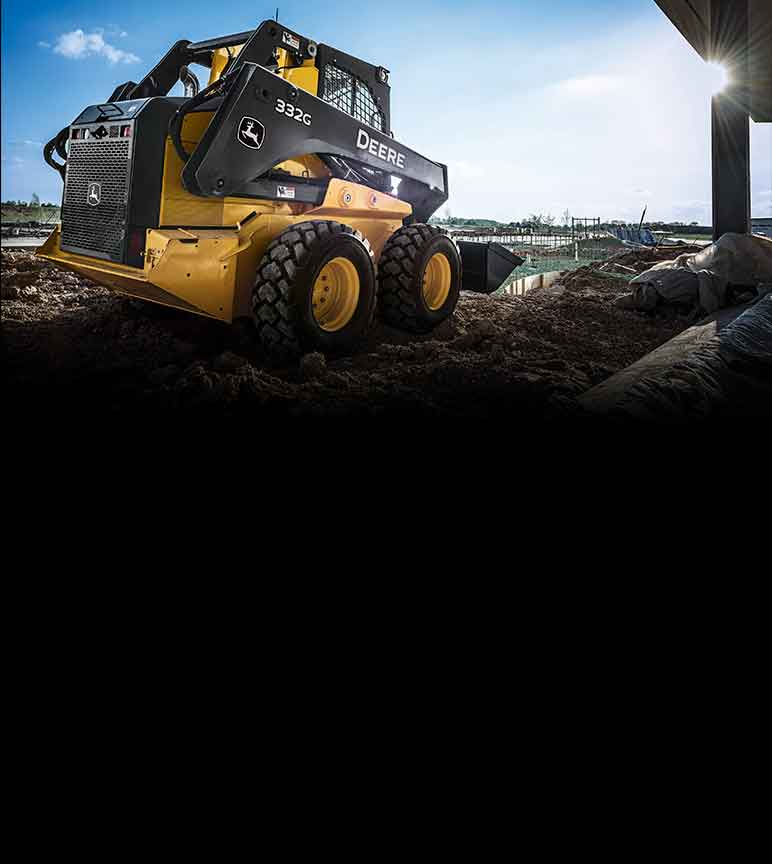

Whether your work calls for a compact excavator, a compact track loader, or a skid steer, John Deere Financial has the right tools to get the equipment you need - so you can manage cash flow and grow your construction business.

Loan Advantages

- You're building equity - you own the equipment when you're done paying for it.

- You can depreciate your equipment.

- The equipment appears as an asset on your balance sheet.

- No hour limits for the time you use the machine.

- Build equity with installment payments.

- You may see tax benefits.†

Lease Advantages

- Pay for the use of the equipment, then return it at lease-end.

- Generally, you may make lower payments than with an installment loan.

- Reduce downtime. Keep newer equipment with the latest technology in your fleet.

- Increase your cash flow with lower payments and generally lower upfront costs.

- You may see tax benefits.†

Compact Construction Equipment Loan or Lease: Questions to Ask†

In addition to filling out an application, start thinking about the answers to these questions before you meet with your John Deere dealer.

- How long will you need the equipment?

- Do you want to own the machine at the end of the term?

- Are you interested in keeping up with the latest technology?

- Are you more concerned about the lease rate or the overall cost?

- Are you just looking for the lowest possible payment?

Used Compact Construction Equipment

John Deere Financial offers competitive financing for the top-quality used compact track loaders, used mini excavators, used mini skid steers, and more offered by your local John Deere dealer.

Put it on PowerPlan™

Free up cash for payroll, subcontractors, business growth, and other equipment. Just put equipment parts, service, attachments, rentals, technology, and more on your PowerPlan commercial credit account.

Construction Financial Tips, Resources, and Expert Advice

You're thinking about your business around the clock. So are we. Check out these articles for fresh ideas and insight for boosting profitability and managing seasonal cash flow.

3 Ways to Purchase Used Equipment

Discover the pros and cons of each to determine which method is best for you.

Calculating Total Cost of Ownership? Don’t Overlook These 5 Factors

Learn why accurate budgeting has to account for much more than the equipment purchase price alone.

Lease or Loan? How Should You Finance Equipment?

See if leasing or taking out an installment loan is right for your construction business.

Construction Email Newsletter

John Deere has a lot of new and exciting things lined up, and we don’t want you to miss out! Get the latest industry news, special offers, and more delivered straight to your inbox.

You May Also Be Interested In

Online Payments

Make managing your John Deere accounts simple and paper-free.

†John Deere Financial does not provide legal or tax advice. Please consult a professional tax advisor or accountant for your specific needs or qualifications.

‡This pricing estimate is for research purposes only. The pricing above is not a price quote and does not represent a financing offer from John Deere Financial or any other party. Actual prices, payments, and taxes may vary. Prices are in US Dollars only. See your local dealer for information and details regarding John Deere Financial and other financing programs.